Alaska Mileage Plan Visa Signature Your Flight Path to Rewards

The card’s features, advantages, and potential risks are carefully examined, along with a detailed comparison to similar credit cards. The ultimate goal is to equip you with the knowledge to make an informed choice regarding this potentially valuable travel rewards card. The breakdown of mileage earning and redemption options, alongside the associated terms and conditions, will be presented clearly in a table format.

Alaska Mileage Plan Visa Signature Benefits

Source: mzstatic.com

The Alaska Mileage Plan Visa Signature card offers a compelling rewards program for frequent travelers and those seeking to maximize their mileage accrual. It leverages a robust rewards structure that goes beyond simply earning miles; it provides a valuable suite of benefits for everyday spending. This detailed exploration will examine the card’s unique advantages, comparing it to other travel rewards cards, and outlining its earning potential and perks.

Rewards Structure Comparison

The Alaska Mileage Plan Visa Signature card stands out in the travel rewards landscape by offering a straightforward and often competitive mileage-earning structure. Compared to other cards, the Alaska Mileage Plan card often prioritizes a higher earning rate in travel-related spending categories, offering an advantage for those who frequently dine at restaurants or utilize rental services. This approach can potentially deliver a higher return on travel-related spending compared to some competing cards.

Mileage Earning Breakdown

The card’s earning structure is designed to reward spending in various categories. Miles are earned based on a tiered system, providing an incentive for higher spending amounts in preferred categories. A breakdown of earning multipliers and categories can significantly impact the overall mileage accrual.

- Travel Spending: This category typically receives the highest earning multipliers, often providing a substantial return on travel-related expenses like flights, hotels, and rental cars. Examples include booking flights directly on airline websites or using travel agencies that facilitate mileage accrual.

- Dining: Restaurants are often a key earning category, offering multipliers for dining out. The value of this category depends on individual spending habits and the restaurant’s participation in the program.

- Everyday Spending: Many everyday purchases, such as groceries or gas, contribute to mileage accrual, albeit at a lower rate than travel-related spending. This provides a broader reward base, encompassing everyday transactions for mileage accumulation.

Perks and Advantages

The card offers numerous advantages beyond mileage earning. These perks often enhance the overall value proposition, making it attractive for various spending habits. Using the card for everyday transactions can significantly boost mileage accumulation.

- No Foreign Transaction Fees: This feature is beneficial for travelers, as it avoids additional charges when making purchases abroad. This directly translates to a higher net return on spending during international trips.

- Extensive Travel Partner Network: The program often partners with various travel providers, providing options for flights, hotels, and rental cars. These partnerships can simplify travel planning and streamline mileage accumulation.

- Membership Advantages: The card may offer benefits beyond travel, such as exclusive access to airport lounges or premium services for registered members.

Detailed Benefit Breakdown

This table summarizes the key benefits of the Alaska Mileage Plan Visa Signature card, outlining the specific conditions and associated benefits.

| Benefit Type | Description | Conditions |

|---|---|---|

| Mileage Earning | Earn miles based on spending in various categories, with higher multipliers for travel-related spending. | Mileage rates vary by category and spending amount. Program terms and conditions apply. |

| No Foreign Transaction Fees | Avoid additional charges when making purchases in foreign currencies. | No foreign transaction fees apply to eligible purchases. |

| Travel Partner Network | Access to a wide range of travel providers for flights, hotels, and rentals. | Partnerships and specific benefits vary; check the program details for specific offers. |

| Membership Advantages | Potential access to exclusive perks like airport lounges or premium services. | Membership status and benefits are subject to program requirements and terms. |

Redeeming Miles and Points

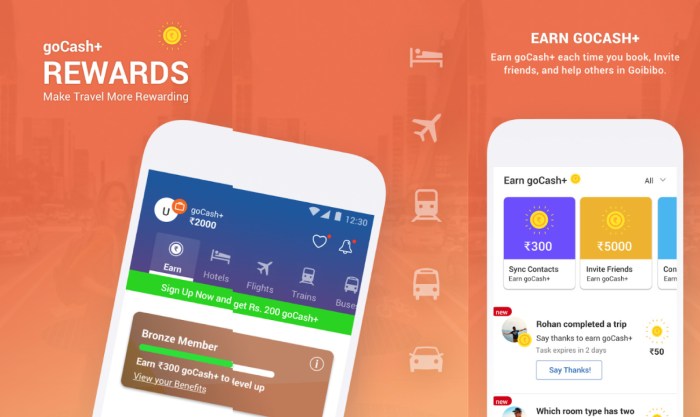

Redeeming your Alaska Mileage Plan Visa Signature miles offers a wide range of travel options. This process allows you to convert accumulated points into tangible travel experiences, including flights, hotels, and vacation packages. Understanding the redemption process and associated terms and conditions is key to maximizing your rewards.

The Alaska Mileage Plan offers flexibility in how you redeem your miles. From booking flights to securing accommodations, your miles are a valuable asset. Careful consideration of redemption options and associated terms and conditions will ensure you get the best possible value for your miles.

Redemption Process Overview

The redemption process typically involves selecting the desired travel experience, entering your mileage plan number, and following the online prompts. Alaska Mileage Plan’s website provides a user-friendly platform for managing your account and redeeming your miles. Detailed instructions are often available on the website and in your account dashboard.

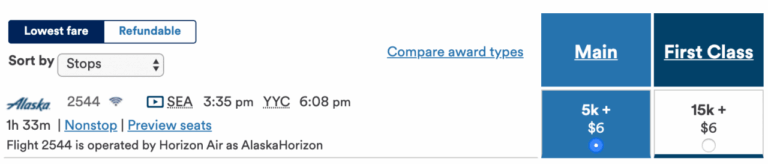

Flight Redemption Options

Booking flights using your miles is a straightforward process. You can often select your desired itinerary and the number of miles you want to use to offset the cost. Availability varies depending on the flight, date, and time. Blackout dates may apply to certain routes or periods, restricting redemption options. Be sure to check the mileage plan website for specific flight redemption rules.

Hotel and Vacation Package Redemptions

Similar to flight redemption, you can use your miles to book hotel stays or vacation packages. The specific process often involves selecting your desired dates and destination, and the number of miles required to cover the costs. Availability and blackout dates may also apply, so reviewing the terms and conditions is essential. These packages often combine flights, hotels, and activities, offering a comprehensive travel experience.

Maximizing Mileage Redemption Value

Strategic planning can maximize the value of your mileage redemption. Consider booking during off-peak seasons or utilizing flexible travel dates. Exploring various redemption options and comparing costs to cash prices will help you make informed decisions. Always read the terms and conditions carefully to understand the specifics of each redemption option.

Example Redemption Options and Costs

| Redemption Option | Description | Cost/Requirements | Example |

|---|---|---|---|

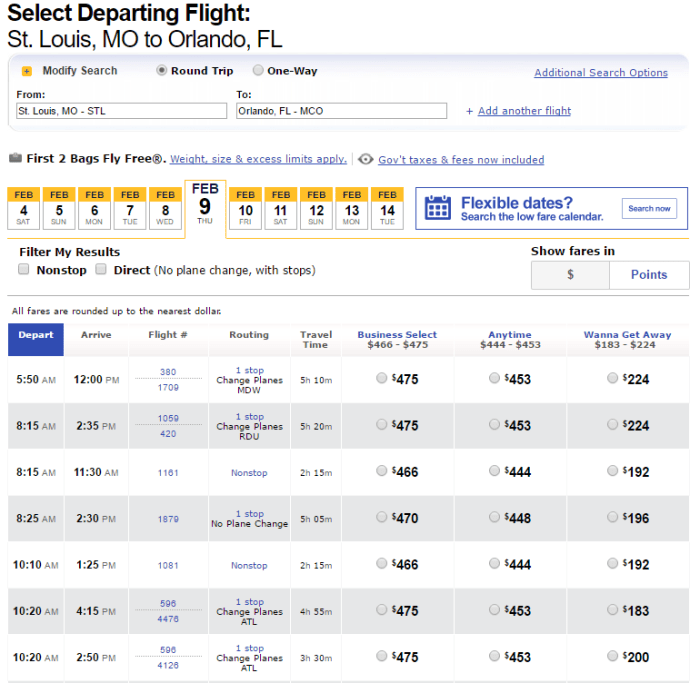

| Flights | Redeeming miles for a one-way or round-trip flight. | Miles required vary based on the flight’s route, distance, and class of service. Blackout dates may apply. | Redeeming 25,000 miles for a one-way flight from Anchorage to Seattle during the off-season. |

| Hotels | Using miles to offset the cost of a hotel stay. | Miles required vary based on the hotel’s location, class, and length of stay. | Redeeming 10,000 miles for a three-night stay at a mid-range hotel in Fairbanks. |

| Vacation Packages | Combining flight, hotel, and potentially other activities. | Miles required vary based on the package’s components. Blackout dates may apply to specific components. | Redeeming 50,000 miles for a 7-day Alaskan cruise package, including flights, accommodation, and excursions. |

Visa Signature Card Features and Responsibilities

The Alaska Mileage Plan Visa Signature card offers a compelling combination of travel rewards and credit card benefits. Understanding its unique features, responsibilities, and potential risks is crucial for informed decision-making. This section provides a comprehensive overview, including application details, fees, and comparisons to other credit cards.

Unique Features

The Alaska Mileage Plan Visa Signature card distinguishes itself from other Visa cards through its robust mileage earning potential tied to the Alaska Airlines Mileage Plan. This feature often includes enhanced perks like priority airport services or access to exclusive events, alongside standard Visa Signature benefits. The card’s rewards program allows users to accrue significant miles for everyday spending, maximizing their travel value.

Responsibilities and Potential Risks

Using a credit card involves certain responsibilities and potential risks. Cardholders must diligently track spending and ensure timely payments to avoid accumulating interest charges. Uncontrolled spending can lead to substantial debt if not managed responsibly. Understanding the card’s terms and conditions, including interest rates and fees, is paramount to avoiding potential financial difficulties. Regularly monitoring account activity and adhering to responsible spending habits are vital.

Creditworthiness and Application Process

Applicants for the Alaska Mileage Plan Visa Signature card will be evaluated based on their creditworthiness. Factors such as credit history, income, and debt-to-income ratio play a crucial role in the application process. Lenders assess these factors to determine the applicant’s ability to repay the credit extended. A strong credit history significantly enhances the chances of approval and favorable interest rates. The specific requirements and application process may vary based on the issuing bank.

Fees

Understanding the associated fees is essential. Annual fees, foreign transaction fees, and late payment fees can impact the overall cost of using the card. Annual fees, if applicable, are a recurring cost for maintaining the card, while foreign transaction fees may apply when using the card outside of the United States. Late payment fees are levied when payments are not made on time, incurring additional costs.

- Annual Fee: This fee, if applicable, is a recurring cost for maintaining the card.

- Foreign Transaction Fee: A percentage or fixed amount charged for transactions made outside the United States.

- Late Payment Fee: A fee assessed for late payments, adding to the overall cost of using the card.

Comparison to Other Cards, Alaska mileage plan visa signature

A comparative analysis of the Alaska Mileage Plan Visa Signature card with other credit cards is provided in the table below. This comparison highlights key features and allows for informed choices based on individual needs and priorities.

| Feature | Alaska Mileage Plan Visa Signature | Other Card (e.g., Chase Sapphire Preferred) |

|---|---|---|

| Annual Fee | $95 (example) | $95 (example) |

| Reward Program | Alaska Airlines Mileage Plan miles | Points or miles with specific partners |

| Foreign Transaction Fee | 3% (example) | No fee (example) |

| Credit Limit | Variable (based on creditworthiness) | Variable (based on creditworthiness) |

Last Word: Alaska Mileage Plan Visa Signature

In conclusion, the Alaska Mileage Plan Visa Signature card presents a compelling rewards program for frequent travelers. By understanding the benefits, mileage earning strategies, and redemption options, users can maximize their travel value. A thorough analysis of the card’s features, responsibilities, and fees will help you determine if it aligns with your individual travel needs and financial goals. Remember to weigh the pros and cons before applying for this card.